Scientific insights: Fabry disease

Fabry disease may seem niche, but it’s becoming a bellwether for how global innovation and modality shifts are reshaping rare disease pipelines.

Few teams are tracking just how quickly the Fabry landscape is evolving.

Using VibeOne, we mapped the global Fabry pipeline and applied AI-driven risk assessments across 70+ programs. Two clear trends emerged here for any biopharma starting a rare disease program or with an existing franchise:

Trend #1: New drugs emerging from overseas

Among the 70+ Fabry assets identified, nearly one in four originated outside the U.S. and Europe:

- 10% from China

- 12% from South Korea

- Additional programs from Argentina and Taiwan

It’s worth noting that a significant portion of the data from these programs wasn’t published in English, which suggests that Fabry innovation is accelerating faster than many Western teams realize. This rise in regional R&D activity could reshape future competitive dynamics and partnership strategies.

Trend #2: The innovation frontier is shifting

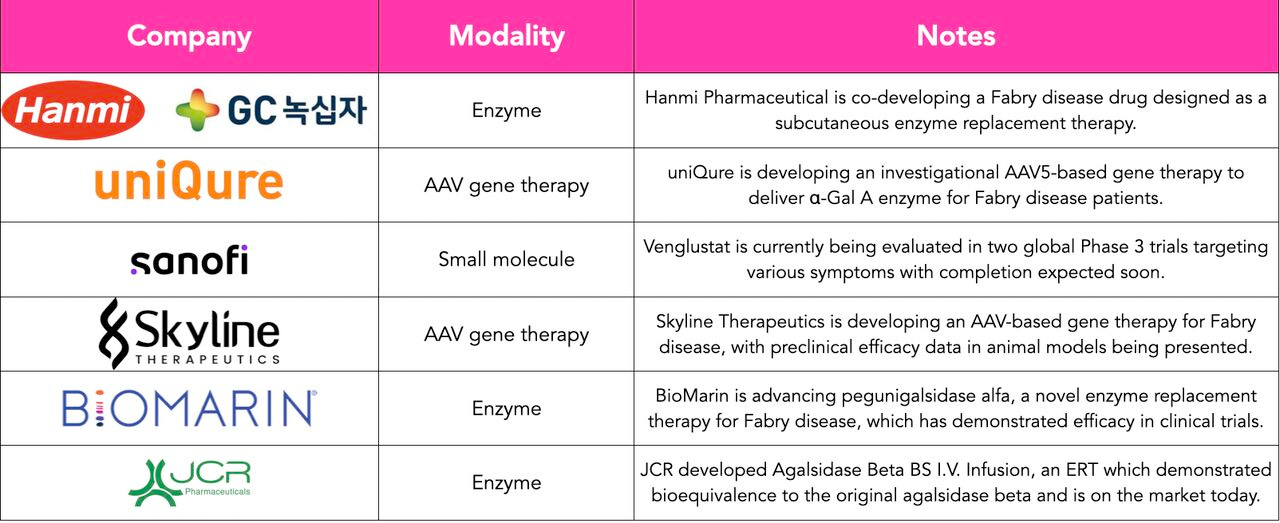

Historically, Fabry R&D has centered on enzyme replacement therapies (ERTs) and molecular chaperones, with commercial successes from Sanofi, Chiesi Group, and others in the space.

But the frontier is moving. Our analysis shows that ~30% of assets in development are now gene therapies or small molecules, modalities promising durable, potentially curative outcomes.

Meanwhile, ERTs appear to be losing ground, as patient experience remains a major unmet need. Many Fabry patients still face infusion times of up to six hours and require 2.5 hours of clinician supervision per treatment session, which is a challenging process for everyone involved.

Spotlight: Skyline Therapeutics’ SKG-0402

One standout program in our analysis was SKG-0402, a gene therapy in development by Skyline Therapeutics, a private biotech based in Shanghai. The company recently shared preclinical data as part of a broader multi-indication strategy.

What makes this asset compelling:

- CMC across multiple indications

- One-and-done potential

- Clear differentiation

- Pathway to accelerated regulatory review

What this means for biopharma teams

Fabry disease may be a niche indication, but it’s a case study in how global R&D acceleration and modality innovation can rapidly reshape a therapeutic area. Companies investing in rare disease portfolios should be monitoring these shifts closely, or risk being outpaced.

Request the full Fabry landscape and AI risk assessment of SKG-0402.