Biopharma BD&L: the tsunami is upon us

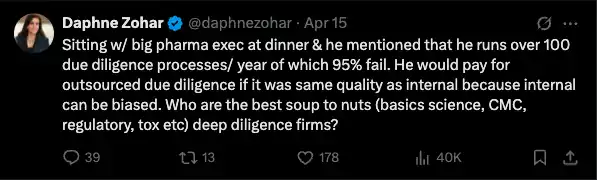

Pharma’s business development and licensing (BD&L) teams are tip-of-the-spear in identifying new science that can support the future of their company. As the biopharma industry navigates an increasingly complex marketplace, the traditional approaches to identifying and evaluating potential drug candidates are showing signs of strain. I’m reminded of a recent insight shared by Founder & CEO of Seaport Therapeutics, Daphne Zohar: major pharmaceutical companies typically run over 100 due diligence processes annually, and 95% of those deals don’t move forward.

This inefficiency isn’t merely a numbers game—it represents billions of dollars in wasted resources across the industry, and, more importantly, frustration across all levels of the organization.

What led to this tsunami

The pressure on BD&L teams stems from several concurrent industry shifts. Pharmaceutical companies face looming patent cliffs, creating the urgent need to fill upcoming revenue gaps in their commercial portfolios. Simultaneously, they must stay ahead of disruptive scientific advances that could potentially make existing franchises obsolete.

The industry is also witnessing a geographic expansion of innovation, with significant developments emerging from Asia, particularly China and Korea. Adding to these challenges, public market expectations have become increasingly demanding, requiring solid clinical data, clear commercialization strategies, fiscal responsibility, and true innovation. Fundamentally, these teams must deliver both scientific breakthroughs and strong financial performance, putting a lot of pressure on the backs of BD&L teams.

4 operational challenges

I’ve seen this pressure manifest in four operational challenges that modern BD&L teams must address in order to weather these challenges.

Strategic alignment

First of all, strategic alignment is always easier said than done. Executive teams, with buy-in from all functional areas, need to be clear about their strengths, weaknesses, and strategy for the pipeline. These could be practical (for example, stage or indication) or conceptual (such as low-risk biology or new clinical trial paradigms). Regardless of exactly what these considerations are, every potential program must align precisely with internal goals, whether those relate to development stages, therapeutic indications, risk profiles, or target product profiles. This alignment isn’t just about finding good science—it’s about finding the right science for the organization’s specific needs and capabilities.

Alignment isn’t just about finding good science—it’s also about finding the right science for the organization’s specific needs and capabilities.

Deluge of top-of-funnel opportunities

In my career, I’ve worked with 500+ biopharma companies. Each one views their search and evaluation efforts as a funnel. Needless to say, in the current climate, teams face an overwhelming top-of-funnel challenge. The democratization of drug development, combined with global innovation sources, has created an unprecedented volume of potential opportunities. BD&L teams, typically operating with a small team, must somehow process and evaluate this expanding universe of possibilities without missing the diamond in the rough.

Kissing many frogs

The evaluation process itself has become increasingly resource-intensive. Teams need to get to “no” quickly, so they can free up resources for the key programs that have the best fit. Sifting the initial large pool of candidates (top of funnel) into a manageable shortlist (deep dive) requires significant effort per asset, even though the program is likely to be rejected. The compounding of resource cost and mental overhead multiplies simply to reach “no” decisions.

Internal bottlenecks

Finally, the efficient use of internal experts has become a critical bottleneck. Every serious evaluation requires input from functional experts (toxicology, clinical development, key opinion leaders). Biases of internal teams don’t help, either. These experts are typically focused and fully engaged in active drug development programs, creating a constant tension between current development and future opportunity assessment. This burden isn’t lost on Chief Business Officers as they get the brunt of frustration from Chief Scientific Officers and Heads of R&D.

Tackling the tsunami

As Daphne’s post highlights, biopharma is actively trying to serve its corporate objectives but is finding it challenging to do so in a scalable and intelligent manner. Augmenting internal teams with external consultants is one common approach. Consulting firms (specialized or general) can support certain workflows easily, like commercial assessments, especially with later stage assets. However, the depth of expertise across every program is limited and it’s expensive and time-consuming to do with a high degree of accuracy.

This broader problem is something we faced at Vibe Bio as we started to invest in early-stage therapeutics. That’s actually part of why we build VibeOne, essentially developing our own solution to automate and streamline the due diligence process. We have the unique opportunity of both building an AI-powered solution and using it to evaluate the funds we invest in. Our goal is to accelerate the risk and reward assessment while reducing costs and improving strategic fit analysis.

AI has the potential to significantly impact this space. For example, by automating initial screening processes and providing data-driven insights, AI can help BD&L teams focus their limited resources on the most promising opportunities. This approach doesn’t replace human expertise; it enhances it, allowing teams to scale their evaluation capabilities without proportionally scaling their headcount.

The pharmaceutical industry will continue to evolve quickly, and as it does, the role of BD&L will be increasingly critical to company success. The ability to efficiently identify, evaluate, and acquire promising drug candidates is likely to determine which companies thrive in the coming decades and which ones are left behind. I anticipate a hybrid approach to BD&L to emerge, one that combines human expertise with artificial intelligence to navigate the increasingly complex landscape of drug development opportunities.